THE MINING BUSINESS CHALLENGE

The Kitsault Project is located 140 km north of Prince Rupert, British Columbia in Canada. It is situated to the south of the head of Alice Arm, an inlet of the Pacific Ocean in the Skeena Mining Division.

The Kitsault Project was a producer of molybdenum between 1967 and 1972 and again between 1981 and 1982. The Kitsault Project is fully permitted for construction with Alloycorp holding a 100% interest in the Project through its wholly owned subsidiary, Avanti Kitsault Mine Ltd.

A Feasibility Study by AMEC was undertaken in 2010. In 2013, an update to the Feasibility Study was prepared which included revised mine planning and metallurgical work. At the request of Avanti Kitsault, Whittle Consulting was engaged to undertake a Whittle Enterprise Optimisation (EO) study in March 2014 to improve Net Present Value (NPV) and validate the project.

THE WHITTLE CONSULTING SOLUTION

Whittle Consulting used existing pit designs and phasing, advanced analytical techniques and proprietary Whittle Enterprise Optimisation software (Prober-B) to create a detailed base case. This work ensured that the Enterprise Optimisation results were aligned with the current business case and that subsequent comparisons and improvements could be measured on an equivalent basis.

Information provided by Avanti Kitsault indicated that the mine had a proposed maximum mining rate of 45.9 Mt per annum, with a 36Mt permitted stockpile space. The proposed processing facility had a 16.6Mtpa processing rate. The proposed flow sheet for the mine featured a flotation circuit and a SAG and ball mill. The life of the mine was determined to be 14 years.

Geological and metallurgical reports showed three rock types. These included:

• Monzonite, phaneritic igneous rock

• Diorite, phaneritic igneous rock (more mafics)

• Hornfels, metamorphic sedimentary rock

A 52% molybdenum concentrate was required for product sales, this was non-negotiable. Silver was included in the revenue, assuming a 39-40% process recovery.

The Whittle Consulting optimisation mechanism included the adaptation of a variable grind size, the use of cut-off and stockpiling and the redevelopment of pits and phases. This optimisation mechanism generated a much better result for the mine operation as a whole.

THE RESULTS

The results of the Whittle Consulting Enterprise Optimisation study for Avanti Kitsault were financially significant. The study unified all available information into a single strategic business model, identifying important value opportunities. The Enterprise Optimisation model also provided a holistic view of the business and a valuable strategic tool for future business planning.

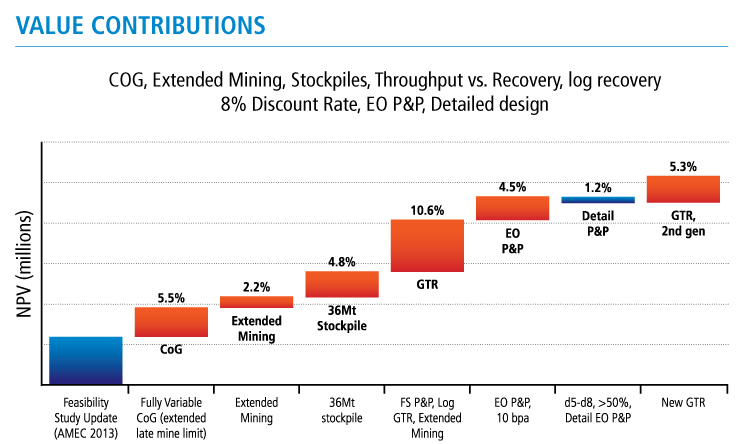

The Whittle Consulting Enterprise Optimisation study determined:

- The new techniques and optimisation mechanisms produced a 31.7% overall increase in NPV, above the best business case of Avanti Kitsault including:

- 7.7% increase in NPV utilising fully variable cut-off value

- 4.8% increase in NPV due to full utilisation of stockpile space

- 10.6% increase in NPV with first generation grind-throughput-recovery (GTR) optimisation

- 3.3% improvement in NPV due to reoptimising the pit and phases

- 5.3% improvement in NPV due to second generation GTR

- Grind throughput recovery was a significant portion of this value, adding half of the realised value.

- Scheduling, cut-off grade and stockpiling to the maximum permitted volume also added value.

- Additional value was added by deferring capital based on the Prober schedule and not utilising the full mining capacity at the start of the project.

- AMEC Mine Planner implemented the “path through the ore body” very well.

- AMEC process consultants took initial Ausenco GTR Estimates and performed additional test work. This further improved the GTR result.

- Overall it was a great team effort!